In 2023, we witnessed a Nike swoosh-style recovery from the previous year's bear market, marked by a substantial pullback during Q3 and a contesting of all-time highs by year-end. Before we delve into my portfolio returns, let's take a look back at the highlights of 2023:

- Focus on earnings growth: In response to declining inflation, the Federal Reserve maintained an accommodative monetary policy. This decision reduced the immediate impact of interest rate decisions on market sentiment, enabling investors to place increased emphasis on earnings growth as a key driver of stock performance.

- Tech sector dominance: The technology sector, led by the "Magnificent 7" comprising Apple, Amazon, Alphabet, Microsoft, Meta, Tesla, and NVIDIA, continued to outperform, showcasing remarkable resilience and growth. These companies thrived on strong consumer demand, technological innovation, and market leadership.

- Low market breadth: Despite the strong performance of tech giants, market breadth remained relatively low, indicating that the market rally was driven by a narrow group of stocks. This divergence underscored the challenges faced by investors seeking broad-based market exposure.

- Hang Seng decline: The Hang Seng index has been in continuous decline since the end of January 2023. Trade disputes with the US and regulatory challenges have significantly dampened investor sentiment. Concerns about China's economic growth prospects and the impact of government policies on various sectors have further exacerbated market uncertainty.

- Higher-for-longer: The Federal Reserve's decisions on interest rates, as reflected in the "dot plot" and "Fed Watch" tool, played a crucial role in shaping market sentiment. Market volatility persisted, driven by factors such as inflation concerns, economic data releases, and geopolitical events.

- Regional banking crisis: Over a span of five days, three US regional banks failed. Extraordinary measures were taken to ensure that all deposits were honored and global industry regulators intervened to provide liquidity.

- Stealth liquidity injection: The Federal Reserve implemented a stealth liquidity injection strategy (BTFP), where it increased its balance sheet through asset purchases without explicitly calling it quantitative easing (QE). This move aimed to provide liquidity to the financial system and support economic growth.

- AI rally: Investors viewed AI as a key driver of future growth and profitability, leading to a surge in demand for stocks of companies at the forefront of AI innovation. This trend contributed to the overall bullish sentiment in the market, particularly in the tech sector.

- Lagging performance of small caps: While tech giants soared, small caps, as represented by the Russell 2000 index, struggled to gain traction. These smaller companies faced challenges such as rising input costs, supply chain disruptions, and limited access to capital, which weighed on their stock prices and overall performance.

- Red Sea security crisis: The blockage of the Red Sea due to geopolitical tensions disrupted global trade and supply chains, impacting various industries. This event underscored the vulnerability of the global economy to unexpected disruptions and the importance of robust supply chain management.

- Positive outlook: Many companies reported positive outlooks in 2023, supported by strong consumer demand, technological innovation, and global economic recovery. Despite challenges such as supply chain disruptions, inflationary pressures, and geopolitical tensions, many companies expressed confidence in their ability to navigate these obstacles and achieve growth.

Portfolio returns

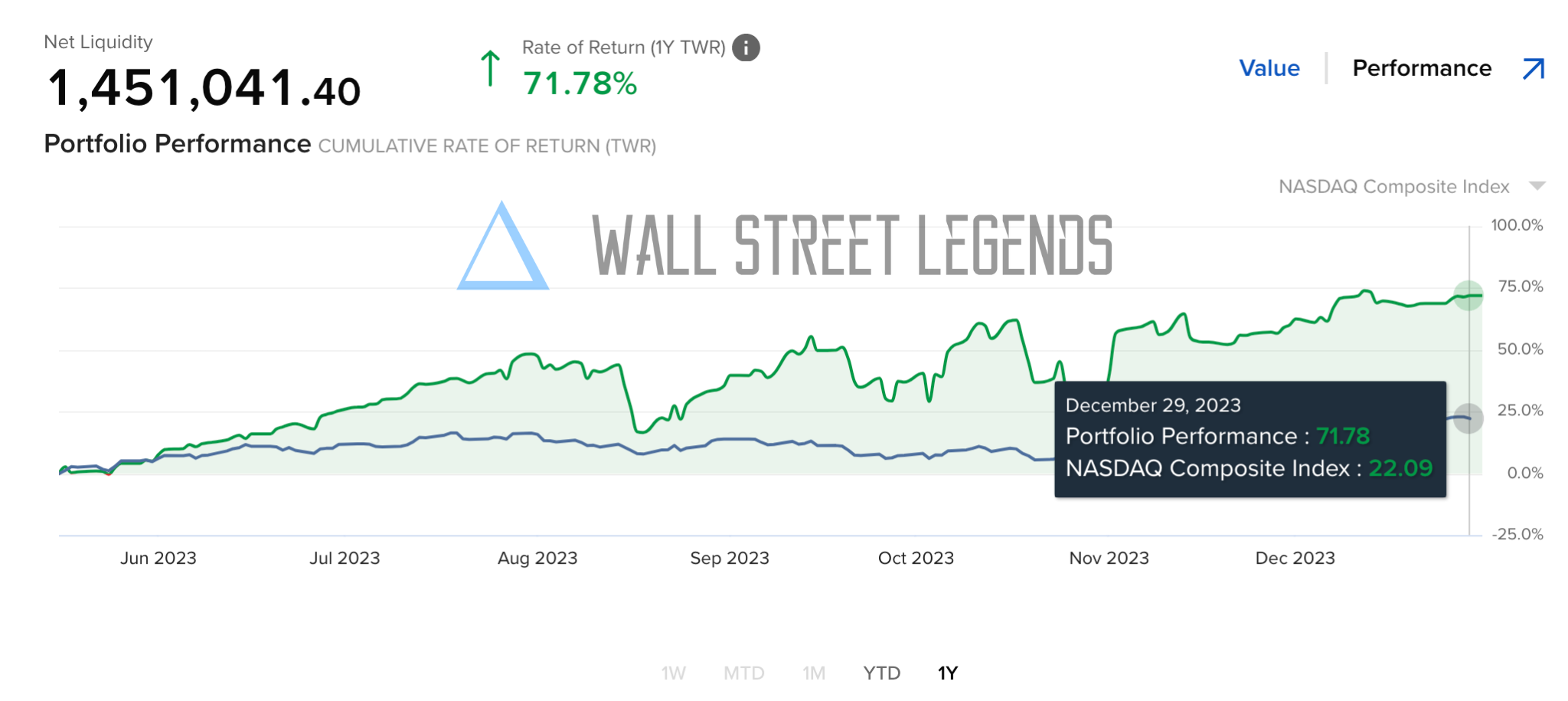

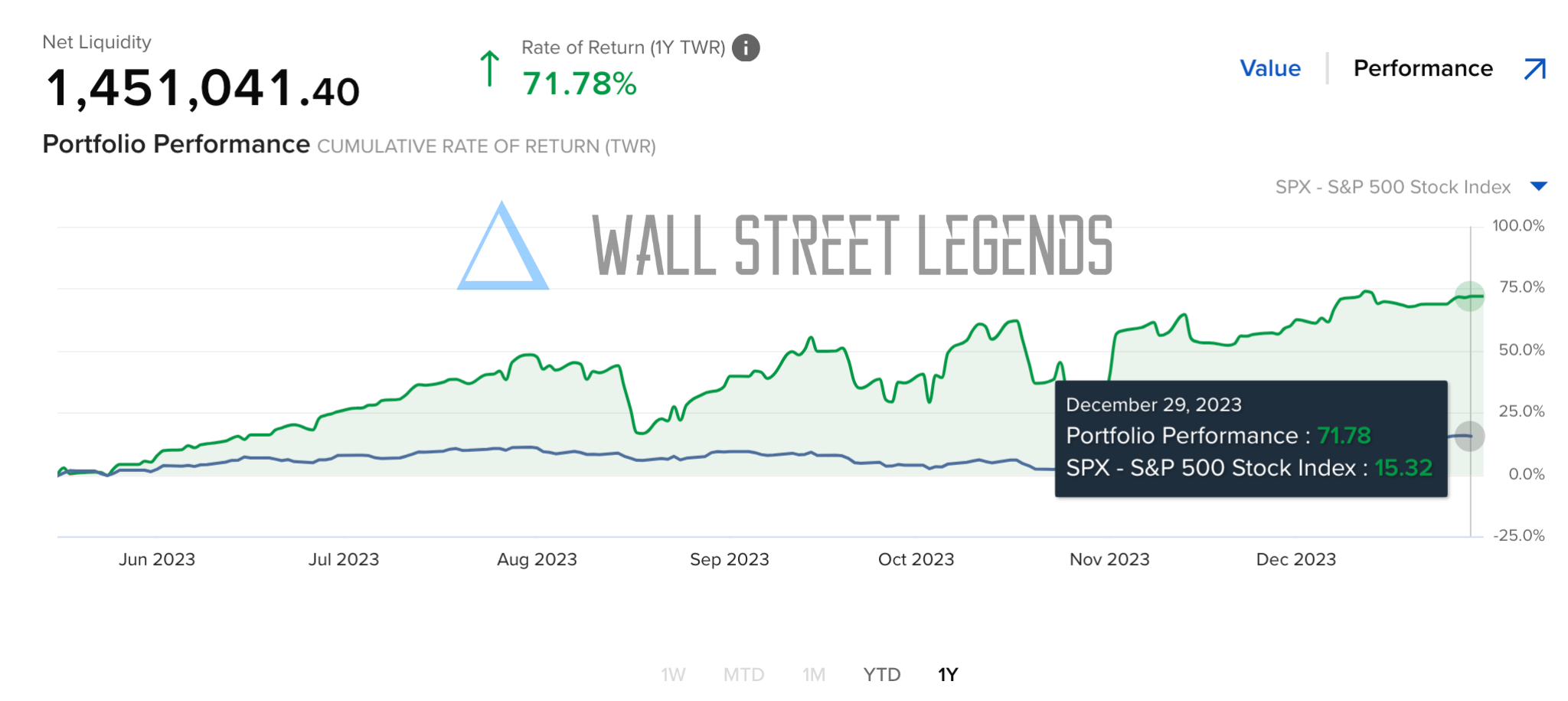

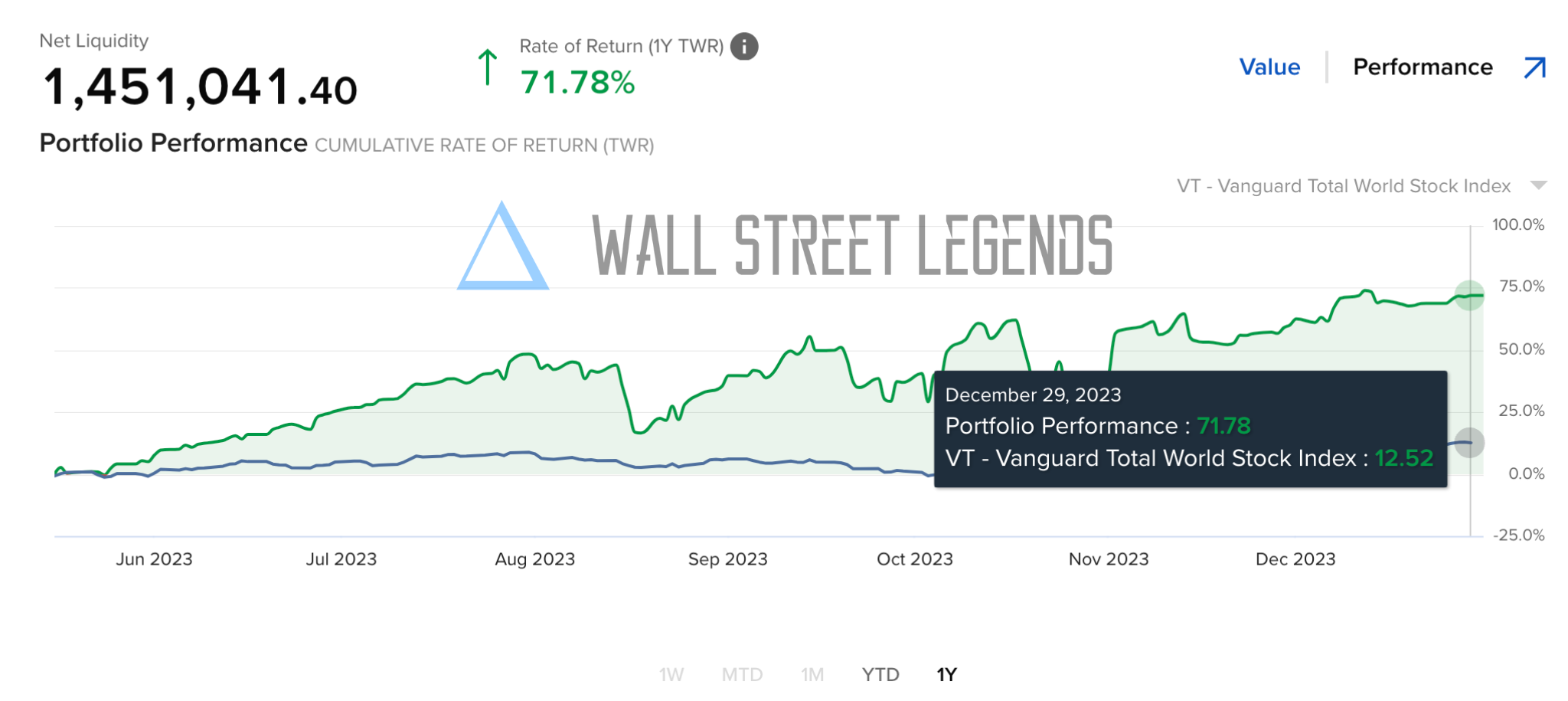

Between May 15, 2023 and the year-end, the S&P 500 returned 15.59%, while the Nasdaq delivered a stronger return of 26.02%. Despite these respectable performances from the benchmarks, I was able to outperform the S&P 500 with 56.37% and the Nasdaq with 45.94% respectively, achieving a time-weighted return (TWR) of 71.78% or € 593,377.52 during the same period. TWR measures the percent return produced over time independent of contributions or withdrawals.

The key factor to my success was the use of options trading strategies. I made trades on the major indices, a variety of individual stocks, and commodities. I have a bread-and-butter strategy that I use throughout the year, but I also look for specific opportunities that might only come once in a while. The use of options allowed me to leverage my positions, make money when the market was moving sideways, and protect myself during corrections.

Options popularity

Options have become increasingly popular among retail investors. The benefit is that this will allow us to trade more products in the near future. However, many new retail investors use options incorrectly, and they end up blowing up their account.

Giving back

I'm passionate about giving back to the community by sharing my options trading strategies. My goal is to teach everyday investors like you how to take control of your financial future. Imagine a life where you no longer worry about bills or retirement survival. Mastering this aspect of your life will have a life-changing impact in the long run. While social connections bring happiness, financial security reduces stress and gives you the freedom to cherish moments with loved ones. If you're eager to master the art of investing in the stock market, reach out to us for a free consultation call.