A Foundation for Investing

Saving is the cornerstone of any successful investment strategy. It's the practice of setting aside a portion of your income for future use, whether it's for emergencies, large purchases, or long-term financial goals like retirement. By saving regularly, you not only build a financial safety net but also create a pool of capital that can be deployed into investments to generate wealth over time.

Choosing the Right Percentage

One of the key decisions in saving is determining how much of your income to set aside. Financial experts often recommend saving between 10% to 50% of your income, depending on your financial goals, income, lifestyle, and other financial obligations. While the ideal percentage may vary from person to person, the important thing is to choose a realistic amount that you can consistently save without straining your finances.

The Importance of Automation

Once you've decided on the percentage of your income to save, the next step is to automate the process. This means setting up a system that automatically transfers the designated percentage of your income into a savings or brokerage account as soon as you receive it. By automating your savings, you remove the temptation to spend the money and ensure that your savings goals are prioritized.

The "Pay Yourself First" Mentality

One common mistake many people make is waiting until the end of the month to save whatever money is left over. Unfortunately, this often results in little to no savings, as most of the income has already been spent. Instead, adopting a "pay yourself first" mentality can be incredibly effective. This means setting aside your savings before paying for any other expenses, effectively making saving a non-negotiable priority.

The Discipline of Do Not Touch

Another crucial aspect of saving is the discipline to leave your savings untouched unless it's for a pre-determined purpose. Whether it's for a down payment on a house, a dream vacation, or retirement, your savings should be reserved for its intended use. By avoiding the temptation to dip into your savings for impulse purchases or non-essential expenses, you stay true to your financial goals and maintain the integrity of your savings strategy.

A realistic example

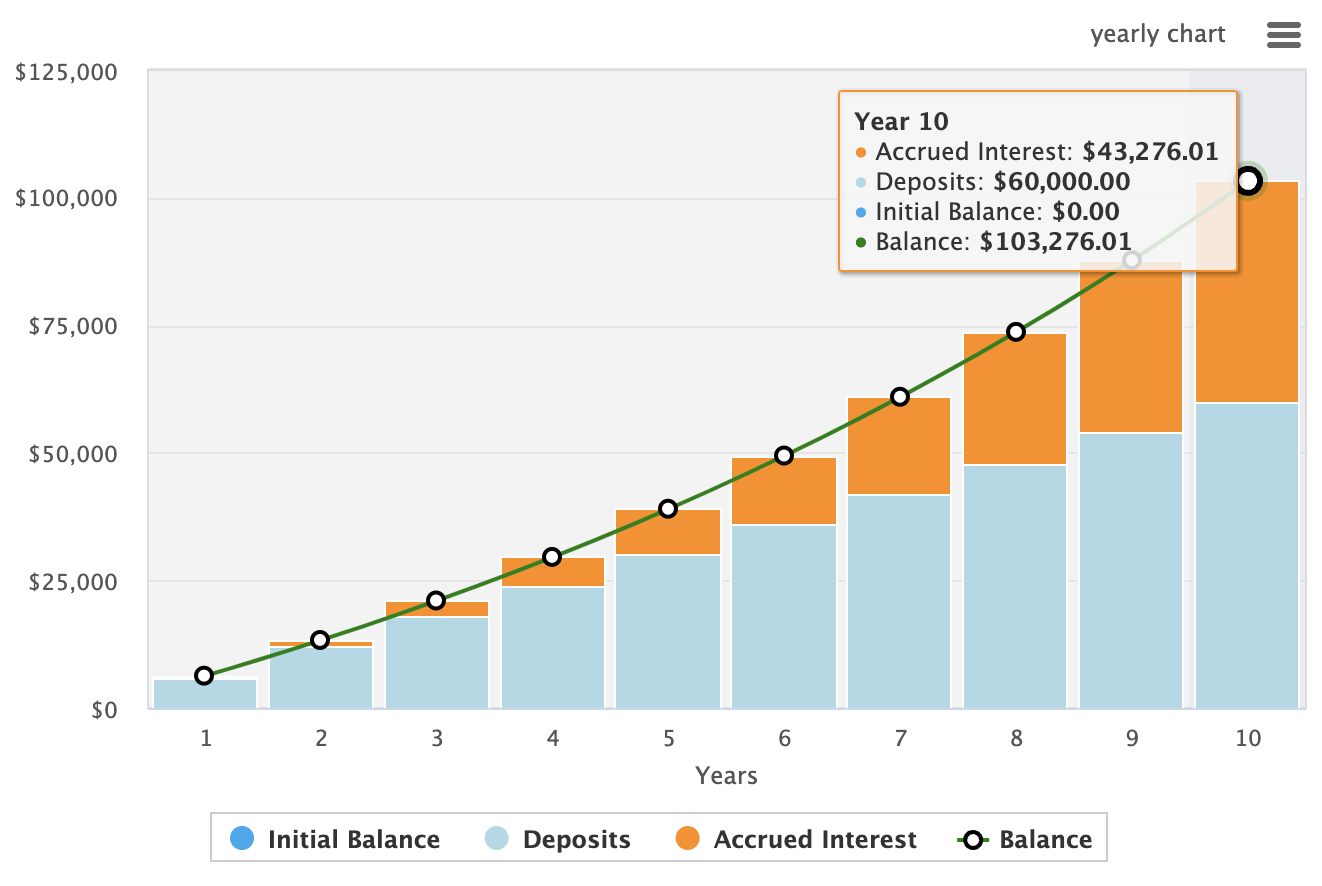

Bob earns $2500 per month and saves 20% of his income. In this scenario, he sets aside $500 each month for savings and keeps $2000 for spending. Over the course of a year, he accumulates a total savings of $6000 (=$500 x 12 months). Over 10 years, this amounts to $60,000. It's important to note that this calculation does not account for any investment returns.

If Bob decides to invest these monthly deposits into the S&P 500, which has an average annual return of 10%, he would end up with $103,276.01 after 10 years.

It's important to be wary of lifestyle creep, a phenomenon where your spending gradually increases as your income rises. As your lifestyle becomes more comfortable, there's a natural tendency to upgrade your possessions, dining habits, and overall standard of living. While these upgrades may seem minor individually, collectively, they can significantly impact your ability to save.

Lifestyle creep can erode your savings in several ways. First, it reduces the amount of money available for saving and investing. If you're constantly increasing your spending to match your income, there's little left over to put towards your financial goals. Second, it can create a cycle of dependence on higher income. As you become accustomed to a certain lifestyle, you may feel the need to maintain or even increase your income to sustain it, putting pressure on your professional life and potentially limiting your options for career changes or entrepreneurial pursuits.

To combat lifestyle creep, it's important to regularly reassess your spending habits and consciously avoid unnecessary increases in expenses. By keeping your lifestyle in check and prioritizing saving and investing, you can ensure that your financial future remains secure, regardless of changes in income or economic conditions.

The First Step to Financial Freedom

In conclusion, learning how to save is not just the first step to investing; it's the foundation of financial success. By deciding on a realistic percentage of your income to save, automating your savings, committing to not touching your savings except for its intended purpose and avoiding lifestyle creep, you will build a solid financial foundation that will serve you well in your investment journey. Remember, it's never too late to start saving, and the sooner you begin, the closer you'll be to achieving your financial goals.