Founded by mathematician and codebreaker James Simons in 1988 and managed by Renaissance Technologies, the Medallion Fund has gained legendary status on Wall Street by consistently delivering staggering returns, outperforming not only the S&P 500 but also the legendary investor Warren Buffett. The fund's success has earned James Simons the title of the most successful hedge fund manager of all time.

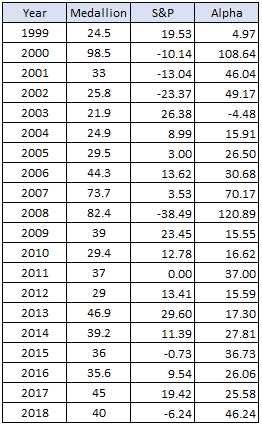

One of the most remarkable aspects of the Medallion Fund's performance is its ability to consistently outperform the broader market, even during periods of extreme volatility. While the S&P 500 is often seen as a benchmark for the overall performance of the stock market, the Medallion Fund has consistently delivered returns that far exceed those of the index. This exceptional performance has led many to wonder what sets the Medallion Fund apart from its peers.

Unlike many traditional hedge funds, which rely heavily on fundamental analysis and qualitative research, the Medallion Fund is known for its quantitative approach to investing. Using complex mathematical models and algorithms, the fund seeks to identify patterns and trends in the market that can be exploited for profit. This data-driven approach allows the fund to make rapid and precise investment decisions, often capitalizing on market inefficiencies that other investors overlook.

The Medallion Fund's portfolio is highly diversified and dynamic. Known for its rapid trading strategy, often holding positions for very short periods of time. This allows it to capitalize on small price movements in the market, generating profits from a large number of trades, both long and short. Additionally, the fund's investments are not limited to a specific sector or industry, allowing it to take advantage of opportunities across the entire market.

One of the secrets behind the Medallion Fund's outperformance is its ability to attract and retain top talent. The fund employs a team of highly skilled mathematicians, scientists, and programmers who are experts in their respective fields. This team is responsible for developing and refining the fund's proprietary trading algorithms, giving it a significant edge over its competitors. Additionally, the fund's compensation structure is designed to incentivize performance, ensuring that its employees are motivated to deliver exceptional results.

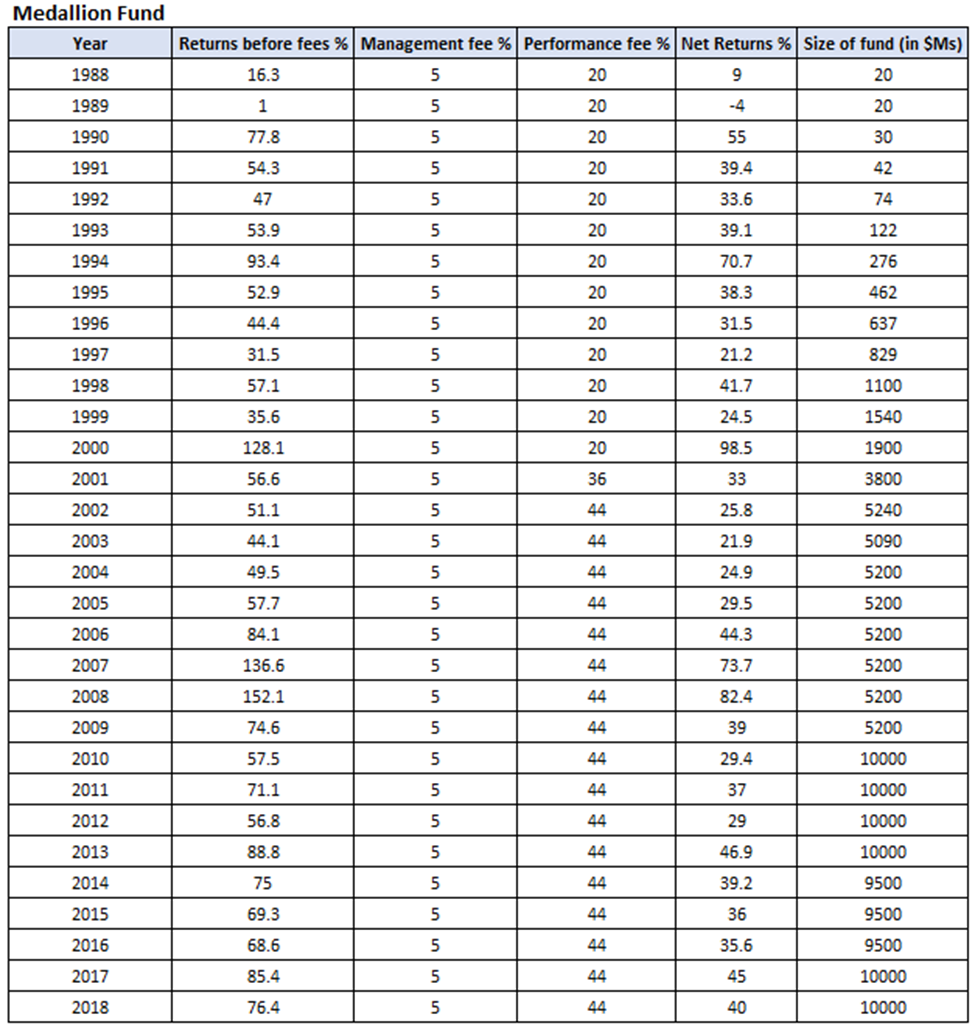

The Medallion Fund's exceptional performance is reflected by its annualized average return of 66% before fees and 37.8% after fees.

2008 marked the Medallion Fund's best returns ever, with approximately +152.10%, while the S&P 500 was down about 37%. This truly highlights its exceptional performance and ability to thrive in challenging market environments. Also during 2002 when the S&P 500 was down about 22%, the Medallion Fund was up 51.10%. Remarkably, the Medallion Fund has never had a negative year, showcasing its resilience and strength as a hedge fund.

The Medallion Fund is the ultimate counterexample of the efficient market hypothesis (EMH), which suggests that it is impossible to consistently outperform the markets over the long-term. This theory, for which Eugene Fama won the Nobel Prize in Economics, is contradicted by the Medallion Fund's remarkable track record.

The Medallion Fund is still active to this day. It charges a 5% management fee and a 44% performance fee, both of which are above the industry standard. However the Medallion Fund has been closed to outside investors since 1993. This exclusivity has only added to the fund's mystique and has made it even more sought after by investors eager to gain exposure to its exceptional track record.

In conclusion, the Medallion Fund's exceptional performance can be attributed to a combination of factors, including its quantitative investment strategy, its use of leverage and risk-management, and its ability to attract and retain top talent. Its track record of turning $100 into nearly $400 million by 2018 (compared to $1815 for the S&P500,) is a testament to its success and has cemented its reputation as one of the most successful and influential hedge funds in the world.

So what can you learn from Medallion Fund to apply to your own investment portfolio?

Quantitative analysis works. Certain patterns from the past tend to reappear and we can be aware of them without the need for complex algorithms.

For example:

- certain months tend to stand out for mostly yielding negative returns,

- the relationship between the dollar index, the 10-year yield and the US stock market,

- market returns during presidential election years,

- what happens when the yield curve uninverts,

- the relationship between Fed liquidity and the US stock market.

Using this market data information can give us an edge in our investment decisions. It's all about making high-probability decisions. Combined with margin and the appropriate level of risk-management this will help us enhance our returns and decrease drawdowns.